|

Buying A Home Still Cheaper Than Renting Despite Rising Home Prices

Even though asking home prices rose 7.0% in the last year, outpacing rent increases of 3.2%, the gap between buying and renting has narrowed only slightly. One year ago, buying was 46% cheaper than renting. Today’s it’s 44% cheaper to buy versus rent. In fact, homeownership is cheaper than renting in all of America’s 100 largest metros. That’s because falling mortgage rates have kept buying almost as affordable, relative to renting. Financial considerationsKnowing where homeownership fits into your larger financial plan is important. Ask yourself: Would I need to make changes in my budget to buy a home? Would it mean stretching to my financial limits? Would owning allow me to still maintain my other savings goals (such as contribution to my retirement fund) and stay prepared for potential costly home emergencies such as a new roof or heating/cooling system? Renting has both advantages and disadvantages. For example, renting may provide you with more leftover cash each month, if your rent is less than a mortgage payment, and renters get to call the landlord to fix the leaky faucet. On the other hand, renters may not be allowed to make any changes to their living space and are often subjected to rent increases over time. Owning a home may provide you with income tax benefits (though it’s important to check with your tax advisor to see how owning would impact your personal situation). Owning a home also offers you the chance to increase your personal wealth as you pay off the Glossary Term:principal layer on your loan over time and build what is known as equity. Glossary Term:Equity layer is the difference between theGlossary Term:market value layer of the home and the outstanding balance of the mortgage loan(s) on the home. Of course, home values can rise or fall over time, so building equity is not guaranteed. And there are significant Glossary Term:upfront costs layer associated with buying, including Glossary Term:down payment layer and Glossary Term:closing costs layer. Personal preferencesOwning a home is a financial commitment that requires you to plan ahead, reflecting on where your life is headed and what you want to accomplish along the way. Ask yourself: What additional financial goals would I like to accomplish as I make payments on a home loan? What’s more important to me: the opportunity to build equity over time or to perhaps have more cash available now? Renting usually makes it easier to relocate (to pursue a job opportunity, for example). And if your rent is less than a mortgage payment, renting could allow you to contribute more toward specific savings goals, such as retirement, college, future travel, investments or even putting away money for a down payment for a home in the future. Owning a home could make sense for you if you want to put your monthly living costs toward something you could eventually pay off and own outright. In addition, it also makes sense if you plan to stay in the area and prefer to feel settled in a home that reflects your personal tastes.

1 Comment

|

Kelly Ann Cameron Archives

February 2024

Categories |

- AT HOME TEXAS

- Meet Our Team

-

Buyer/Seller Tips

- Role of a Real Estate Agent

- What's My Home Worth?

- Are you Ready for Home Ownership?

- To Buy or Build?

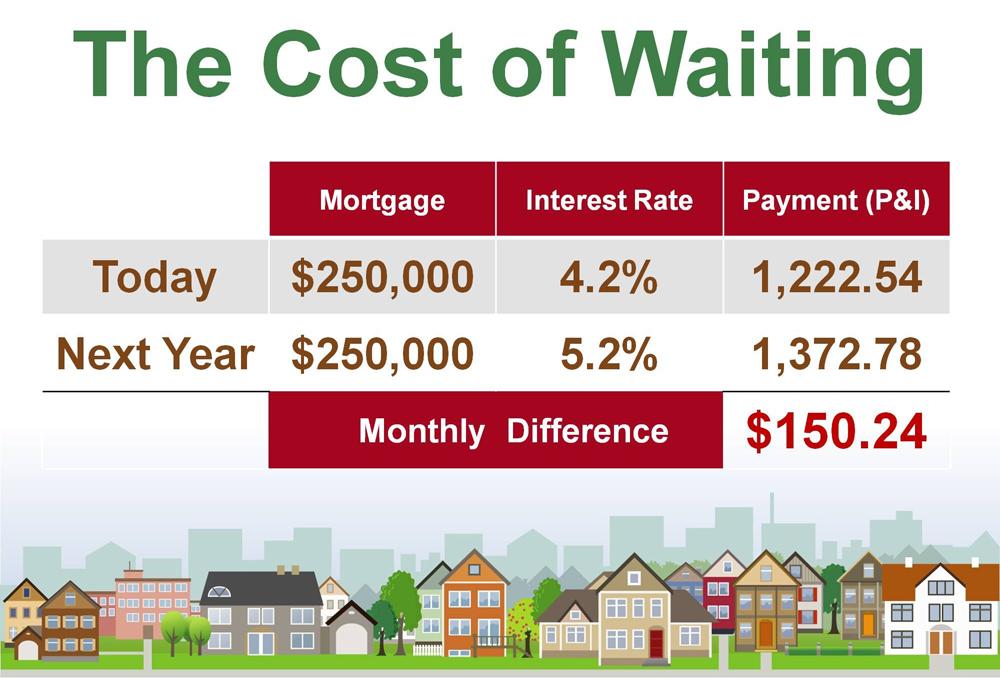

- Buy Now or Later?

- Important Keys to Selling Your Home

- Preparing Your Home for the Market

- Home Appraisal Basics

- Mortgage Application Checklist

- Getting Pre-Approved

- FHA Loans

- Credit Report Review Checklist

- Client Gallery

- Happy Clients

- Homeowning Tips

- Rental Tips

- Blog

- New Page

Your #1 San Antonio, Tx. Realtors,

At Home In Texas

210 859 4700

At Home In Texas

210 859 4700

San Antonio Real Estate and Property Information Provided by Kelly Ann Cameron, At Home Texas Realty LLC, doesn not assume any liability or responsiblity for the content of any linked resouces, nor any interpetatations, comments, graphics, or opinions contained therein. All Information deemed reliable but not guaranteed. At HomeTexas Realty. is a licensed real estate brokerage in the State of Texas, Equal Opportunity Employer, and supporter of the Fair Housing Act. All Content @ 2009-2016 unless otherwise noted |

RSS Feed

RSS Feed