|

Buying A Home Still Cheaper Than Renting Despite Rising Home Prices

Even though asking home prices rose 7.0% in the last year, outpacing rent increases of 3.2%, the gap between buying and renting has narrowed only slightly. One year ago, buying was 46% cheaper than renting. Today’s it’s 44% cheaper to buy versus rent. In fact, homeownership is cheaper than renting in all of America’s 100 largest metros. That’s because falling mortgage rates have kept buying almost as affordable, relative to renting. Financial considerationsKnowing where homeownership fits into your larger financial plan is important. Ask yourself: Would I need to make changes in my budget to buy a home? Would it mean stretching to my financial limits? Would owning allow me to still maintain my other savings goals (such as contribution to my retirement fund) and stay prepared for potential costly home emergencies such as a new roof or heating/cooling system? Renting has both advantages and disadvantages. For example, renting may provide you with more leftover cash each month, if your rent is less than a mortgage payment, and renters get to call the landlord to fix the leaky faucet. On the other hand, renters may not be allowed to make any changes to their living space and are often subjected to rent increases over time. Owning a home may provide you with income tax benefits (though it’s important to check with your tax advisor to see how owning would impact your personal situation). Owning a home also offers you the chance to increase your personal wealth as you pay off the Glossary Term:principal layer on your loan over time and build what is known as equity. Glossary Term:Equity layer is the difference between theGlossary Term:market value layer of the home and the outstanding balance of the mortgage loan(s) on the home. Of course, home values can rise or fall over time, so building equity is not guaranteed. And there are significant Glossary Term:upfront costs layer associated with buying, including Glossary Term:down payment layer and Glossary Term:closing costs layer. Personal preferencesOwning a home is a financial commitment that requires you to plan ahead, reflecting on where your life is headed and what you want to accomplish along the way. Ask yourself: What additional financial goals would I like to accomplish as I make payments on a home loan? What’s more important to me: the opportunity to build equity over time or to perhaps have more cash available now? Renting usually makes it easier to relocate (to pursue a job opportunity, for example). And if your rent is less than a mortgage payment, renting could allow you to contribute more toward specific savings goals, such as retirement, college, future travel, investments or even putting away money for a down payment for a home in the future. Owning a home could make sense for you if you want to put your monthly living costs toward something you could eventually pay off and own outright. In addition, it also makes sense if you plan to stay in the area and prefer to feel settled in a home that reflects your personal tastes.

1 Comment

01/10/2017 | Author: TAR Legal Staff The Possession Paragraph in TREC contracts includes a checkbox for delivering the property to the buyer “upon closing and funding.” Sometimes there can be confusion about when the funding part of that provision has occurred because it is not defined in the contracts. A transaction is considered to have closed and funded when the title company is prepared to issue funds—not when the funds are actually received in the seller’s bank account. Another way to describe it: A transaction has closed and funded when there are no conditions left that prevent the title company from moving forward. People may think that a wire transfer is an instantaneous transaction; however, there are manual steps that must be taken by the receiving bank before the funds show up in the recipient’s account. It’s possible for wire transfers that occur at the end of a day to not be displayed in the seller’s bank account until the next morning or after the weekend. Nevertheless, the transaction has closed and funded. The seller must deliver the property to the buyer. Note that if the title company has a federal wire reference number (often called a “fed number”), then the wire has been sent, regardless of whether the recipient’s bank has found that wire or posted it to the seller’s account. Reprinted from the December 2016 issue of Texas REALTOR® magazine.  Don't trash your Christmas tree — recycle it into nutrient-rich mulch for your garden! There are drop-off locations throughout the city that will be in operation on two separate weekends.In an effort to minimize the amount of landscape debris entering the landfill, the City of San Antonio Solid Waste Management Department is once again providing locations where you can take your Christmas trees to be recycled into mulch. The sites are located throughout the city and will be in operation on two separate weekends from 8 a.m. to 1 p.m.

2017 Christmas Tree Drop-Off Sites Click to view map. Rusty Lyons Sports Complex6300 McCullough78212 Bitters Brush Center 1800 Wurzbach Pkwy78216 Southside Drop-off Center 5450 Castroville Road78227 Southeast District Center7402 S. New Braunfels78223 Northwest District Center 6802 Culebra Road 78238 Northeast District Center10303 Tool Yard78233 Nelson Gardens8963 Nelson Road78252 Eisenhower Park19399 NW Military78257 Stone Oak Park 20395 Stone Oak Pkwy78258 Pine or juniper tree mulch is excellent for both gardens and landscape beds, especially if some needles are included. The needles, bark and woodchips of these trees tend to be acidic in pH, which assists in nutrient cycling within the soil. Plus, there's that wonderful aroma! If you can't make it to the brush recycling centers, another great option is to use the tree somewhere in your landscape as winter shelter for resident and migrating birds. Simply cut it up into pieces about 2 ½ to 3 feet long and create little teepees or square boxes in the back of your yard. Wildlife will appreciate these snug little homes during the winter and early spring months. What about a repurpose option? You can accessorize your old Christmas tree with edible and attractive nuts, peanut butter and citrus, place in a corner of the backyard, and then sit back and watch your feathered friends frolic and feast! Don't let this wonderful landscape asset go to the landfill. Use as much Christmas mulch as possible so you can keep a little Christmas in the yard all year round or provide our feathered and furry friends a little holiday treat  Pamper your poinsettia. With proper care it’ll serve you long after the holidays as a xeric evergreen perennial in your landscape. Living in South Texas has its perks. One of them is the opportunity to grow poinsettias for annual holiday beauty. If you’ve been taking proper care of the poinsettias prior to and during the holidays, then you have the opportunity that many people in the rest of the country do not. Incorporate them into your landscape for perpetual beauty! Poinsettia is a semi-tropical but semi-arid plant. In other words, it does not like temperatures below 40 degrees or being watered every week. It’s a perfect plant for a large container outdoors or a specific bed in the landscape. Follow these tips to keep your poinsettias thriving during the holidays.

Selling your home doesn′t just mean hiring a realtor to stick a sign out front. There are a lot of preparations you should make to ensure you get the best offer possible in the shortest time. Repair. Just because you’ve gotten used to the cracks in the walls and the rattles in the radiators doesn’t mean a buyer will too. If you have hardwood floors that need refinishing, be sure to get it done—hardwood is a huge selling point. Buyers like to snoop around, so be sure to fix any sticky doors or drawers as well. Finally, don’t forget to address any issues with the exterior—fences, shingles, sidewalks, etc. After all, without curb appeal, some buyers may never get to see the inside. Neutralize. You want buyers to see themselves in your home. If your living room has lime green shag, wood-paneled walls, and all your collectibles and personal photographs, this will be much harder for them to do. Try replacing any bold color choices in your floors and walls with something more neutral—beiges, tans, and whites. Repainting and reflooring will make everything look fresh and new, and help prospective buyers imagine all the possibilities. Stage. Once your house is clean and updated, it’s time to play dress up. Home stagers can add small details and décor touches that will bring out the possibilities in the various spaces in your home: lamps, mirrors, throw rugs and pillows, flowers, decorative soaps and towels, patio furniture. Home staging can be particularly useful if your home is especially old or if the exterior looks dated. Think of it as a little mascara and rouge—if it’s done right, you notice the beauty, not the makeup.  As the events of the last few years in the real estate industry show, people forget about the tremendous financial responsibility of purchasing a home at their peril. Here are a few tips for dealing with the dollar signs so that you can take down that “for sale” sign on your new home. Get pre-approved. Sub-primes may be history, but you’ll probably still be shown homes you can’t actually afford. By getting pre-approved as a buyer, you can save yourself the grief of looking at houses you can’t afford. You can also put yourself in a better position to make a serious offer when you do find the right house. Unlike pre-qualification, which is based on a cursory review of your finances, pre-approval from a lender is based on your actual income, debt and credit history. By doing a thorough analysis of your actual spending power, you’ll be less likely to get in over your head. Choose your mortgage carefully. Used to be the emphasis when it came to mortgages was on paying them off as soon as possible. Today, the debt the average person will accumulate due to credit cards, student loans, etc. means it’s better to opt for the 30-year mortgage instead of the 15-year. This way, you have a lower monthly payment, with the option of paying an additional principal when money is good. Additionally, when picking a mortgage, you usually have the option of paying additional points (a portion of the interest that you pay at closing) in exchange for a lower interest rate. If you plan to stay in the house for a long time—and given the current real estate market, you should—taking the points will save you money. Do your homework before bidding. Before you make an offer on a home, do some research on the sales trends of similar homes in the neighborhood with sites like Zillow. Consider especially sales of similar homes in the last three months. For instance, if homes have recently sold for 5 percent less than the asking price, your opening bid should probably be about 8 to 10 percent lower than what the seller is asking. |

Kelly Ann Cameron Archives

February 2024

Categories |

- AT HOME TEXAS

- Meet Our Team

-

Buyer/Seller Tips

- Role of a Real Estate Agent

- What's My Home Worth?

- Are you Ready for Home Ownership?

- To Buy or Build?

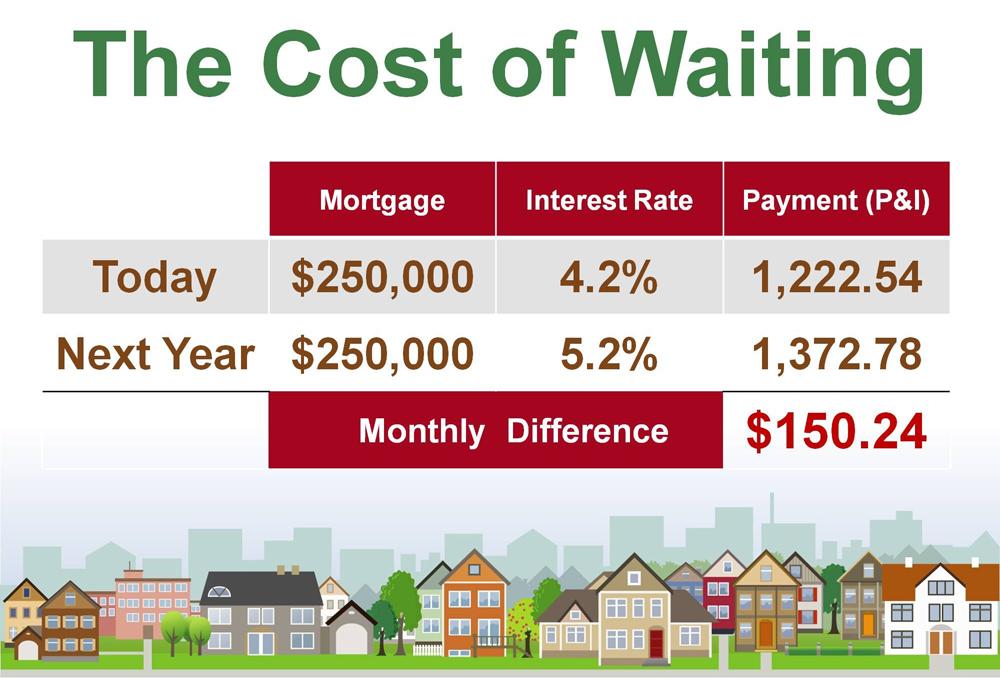

- Buy Now or Later?

- Important Keys to Selling Your Home

- Preparing Your Home for the Market

- Home Appraisal Basics

- Mortgage Application Checklist

- Getting Pre-Approved

- FHA Loans

- Credit Report Review Checklist

- Client Gallery

- Happy Clients

- Homeowning Tips

- Rental Tips

- Blog

- New Page

Your #1 San Antonio, Tx. Realtors,

At Home In Texas

210 859 4700

At Home In Texas

210 859 4700

San Antonio Real Estate and Property Information Provided by Kelly Ann Cameron, At Home Texas Realty LLC, doesn not assume any liability or responsiblity for the content of any linked resouces, nor any interpetatations, comments, graphics, or opinions contained therein. All Information deemed reliable but not guaranteed. At HomeTexas Realty. is a licensed real estate brokerage in the State of Texas, Equal Opportunity Employer, and supporter of the Fair Housing Act. All Content @ 2009-2016 unless otherwise noted |

RSS Feed

RSS Feed