|

During the busy rental season you may find that you're being pulled in multiple directions. If you want to stay on top of things, you will need to have your process and policies set before you jump in the middle of it. This includes how you will handle a variety of fees. Before things get too crazy, take a few minutes to consider the following about rental fees and deposits:

0 Comments

7 Steps to Take Before You Buy a HomeBy: G. M. Filisko Published: February 10, 2010 By doing your homework before you buy, you’ll feel more content about your new home. Most potential home buyers are a smidge daunted by the fact that they’re about to agree to a hefty mortgage that they’ll be paying for the next few decades. The best way to relieve that anxiety is to be confident you’re purchasing the best home at a price you can afford with the most favorable financing. These seven steps will help you make smart decisions about your biggest purchase. 1. Decide How Much Home You Can Afford Generally, you can afford a home priced two to three times your gross income. Remember to consider costs every homeowner must cover: property taxes, insurance, maintenance, utilities, and community association fees, if applicable, as well as costs specific to your family, such as day care if you plan to have children. 2. Develop Your Home Wish List Be honest about which features you must have and which you’d like to have. Handicap accessibility for an aging parent or special needs child is a must. Granite countertops and stainless steel appliances are in the bonus category. Come up with your top five must-haves and top five wants to help you focus your search and make a logical, rather than emotional, choice when home shopping. 3. Select Where You Want to Live Make a list of your top five community priorities, such as commute time, schools, and recreational facilities. Ask a REALTOR® to help you identify three to four target neighborhoods based on your priorities. 4. Start Saving Have you saved enough money to qualify for a mortgage and cover your down payment? Ideally, you should have 20% of the purchase price set aside for a down payment, but some lenders allow as little as 5% down. A small down payment preserves your savings for emergencies. However, the lower your down payment, the higher the loan amount you’ll need to qualify for, and if you still qualify, the higher your monthly payment. Your down payment size can also influence your interest rate and the type of loan you can get. Finally, if your down payment is less than 20%, you’ll be required to purchase private mortgage insurance. Depending on the size of your loan, PMI can add hundreds to your monthly payment. Check with your state and local government for mortgage and down payment assistance programs for first-time buyers. 5. Ask About All the Costs Before You Sign A down payment is just one home buying cost. A REALTOR® can tell you what other costs buyers commonly pay in your area -- including home inspections, attorneys’ fees, and transfer fees of 2% to 7% of the home price. Tally up the extras you’ll also want to buy after you move-in, such as window coverings and patio furniture for your new yard. 6. Get Your Credit in Order A credit report details your borrowing history, including any late payments and bad debts, and typically includes a credit score. Lenders lean heavily on your credit report and credit score in determining whether, how much, and at what interest rate to lend for a home. The minimum credit score you can have to qualify for a loan depends on many factors, including the size of your down payment. Talk to a REALTOR® or lender about your particular circumstance. You’re entitled to free copies of your credit reports annually from the major credit bureaus: Equifax, Experian, and TransUnion. Order and then pore over them to ensure the information is accurate, and try to correct any errors before you buy. If your credit score isn’t up to snuff, the easiest ways to improve it are to pay every bill on time and pay down high credit card debt. 7. Get Prequalified Meet with a lender to get a prequalification letter that says how much house you’re qualified to buy. Start gathering the paperwork your lender says it needs. Most want to see W-2 forms verifying your employment and income, copies of pay stubs, and two to four months of banking statements. If you’re self-employed, you’ll need your current profit and loss statement, a current balance sheet, and personal and business income tax returns for the previous two years. Consider your financing options. The longer the loan, the smaller your monthly payment. Fixed-rate mortgages offer payment certainty; an adjustable-rate mortgage (ARM) offers a lower monthly payment. However, an adjustable-rate mortgage may adjust dramatically. Be sure to calculate your affordability at both the lowest and highest possible ARM rate. Seven Deadly Seller Sins

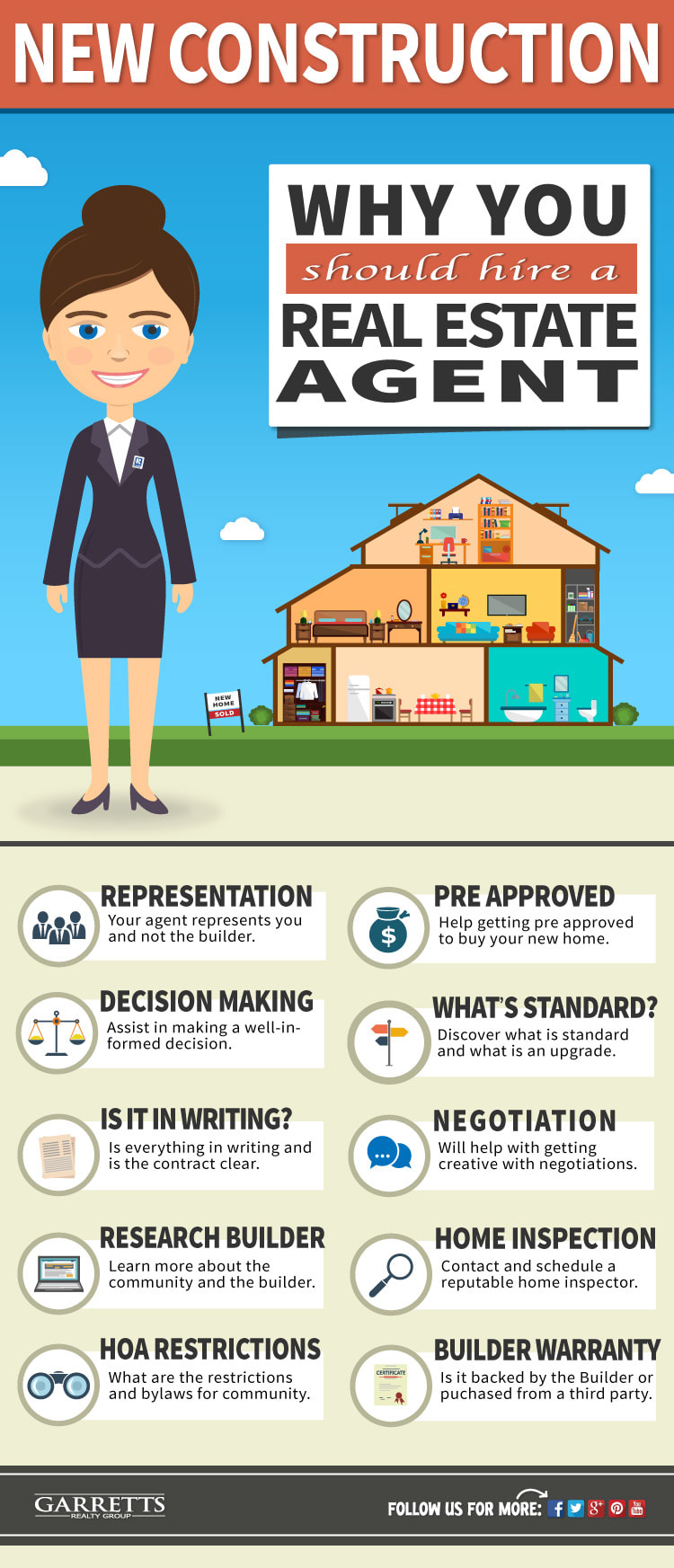

Several seller mistakes or misconceptions occur rather predictably in residential real estate, in particular: Pricing higher than the competition. Refusing reasonable offers early on. Not putting the property in the best possible condition for sale. Making showing the property difficult. Not recognizing that a seller’s home is a buyer’s house (a commodity with no emotional attachment). Blaming the agent for the market. Not reducing the price in a timely manner, causing market aging. Advantage accrues to agents who anticipate these “sins” and help their clients overcome them. Five Buyer Bloopers Buyers, also, are prone to certain transgressions: Believing AVMs have the right value. Listening to people who bought houses years ago—the market has changed. Believing people who insist that every house is overpriced by X%.  When you're house hunting, the allure of new construction is undeniable. You get to be the first to live in the pristine home - one untouched by grimy hands or muddy shoes. It's full of brand-new appliances and the finishes and treatments that you picked to fit your tastes. And you won't have to worry about making any cosmetic or structural upgrades for years. If you are interested in buying a new construction, the builder's agent will be ready to help you with the process. But make no mistake: You need your own real estate agent from the get-go. Even if it seems like plug and play to sign up with the builder's on-site agent, you're going to want someone representing your side of the deal. What is a builder's agent? When you buy a new construction, the home's builder is considered the seller, and the agent representing the builder is called the builder's agent. That agent's job is to always have the builder's best interest in mind. After all, the job of the builder's agent is to get the highest price for the homes the builder is selling so the agent is not going to be as eager to negotiate down. Why you should hire your own real estate agent It's a good idea to have your real estate agent accompany you on your first visit to the new construction. Why? Because the builder (aka the seller) will be responsible for paying the commission, and needs to know if you'll have a real estate agent representing you. So bringing your agent to the first visit will make it clear that the builder's agent will be on the hook for paying commission. Some builders might even refuse to pay your agent a commission if you don’t register the agent the first time you visit the home on a new construction site. It will be the job of your agent to get the most value for your money, and to help the process run smoothly. When buying new construction, here’s what your real estate agent will help you with that you might miss out on if you stick with the builder’s agent:

All that said, the builder's agent can be a valuable resource for learning about your potential new home. Since they likely have represented the builder since construction of the housing development began, they are knowledgeable about the selection of homes being built, optional amenities, and the visions for the community. You can rely on the builder's agent for background information—just don’t make this individual your sole point of contact on the buying and selling process. Pax Real Estate Agents Are Here to Help Everyone wants to walk away from buying a home with peace of mind - whether it be a new construction or not. Having a real estate agent in your corner will help facilitate that. If you are considering building your own home, we've compiled a list of new construction properties available now (several of which are Pax listings). The list consists of newly-constructed homes, homes to be built, and vacant land in Calvert County. Looking in other areas and/or other types of property? Give us a call. Pax agents are here to help you find your dream home! |

Kelly Ann Cameron Archives

February 2024

Categories |

- AT HOME TEXAS

- Meet Our Team

-

Buyer/Seller Tips

- Role of a Real Estate Agent

- What's My Home Worth?

- Are you Ready for Home Ownership?

- To Buy or Build?

- Buy Now or Later?

- Important Keys to Selling Your Home

- Preparing Your Home for the Market

- Home Appraisal Basics

- Mortgage Application Checklist

- Getting Pre-Approved

- FHA Loans

- Credit Report Review Checklist

- Client Gallery

- Happy Clients

- Homeowning Tips

- Rental Tips

- Blog

- New Page

Your #1 San Antonio, Tx. Realtors,

At Home In Texas

210 859 4700

At Home In Texas

210 859 4700

San Antonio Real Estate and Property Information Provided by Kelly Ann Cameron, At Home Texas Realty LLC, doesn not assume any liability or responsiblity for the content of any linked resouces, nor any interpetatations, comments, graphics, or opinions contained therein. All Information deemed reliable but not guaranteed. At HomeTexas Realty. is a licensed real estate brokerage in the State of Texas, Equal Opportunity Employer, and supporter of the Fair Housing Act. All Content @ 2009-2016 unless otherwise noted |

RSS Feed

RSS Feed